Sponsor Ads

Non-China Vape, 510 Cartridges & Battery Device Maker

If you are going for a vape manufacturer out of China we are you best choice. We offer a alternative vape production location with a very competitive price. You can save money by buying directly from us the manufacturer, without any middlemen or extra fees. You can also enjoy discounts for bulk orders and special offers for long term & loyal customers.

We offer small trial orders where you can test the quality and performance of the products before placing a large order. Fast shipping and cheaper shipping cost from Malaysia and Singapore ports. You don't have to wait long to receive your products.

Contact Us!

Contribute for our website Maintenance! We want to keep it free for all visitors.

Trending Best Sellers

Buying gold-A comprehensive guide!

There are different ways for buying gold depending on the size of your investment and your objectives. The bigger your investment, the better equipped you are with all professional aids, analysis, experts tracking market trends and news flows and more. But, for the marginal or retail investor, this is often not the case and investment decisions come more out of impulse rather than an informed strategy.

When you are buying gold the first time, you are lured into a number of ‘irresistible offers by the scam artists. Therefore, the basic fact to remember is that there are no big bargains available in gold and if anyone is offering prices substantially lower than the current market price, you must have your eye brows up and preferably walk away to a more reliable vendor. A small premium is most often added to the day’s prices to account for the trader’s profits, overheads and taxes. A discount on gold is never offered when you are buying gold in grams.

What you need to know before buying gold

Before buying gold, it helps to understand your shopping destination and relate it to your objectives. More importantly you should understand the difference between pure gold and gold mixed with other metals. Physical gold should always be accompanied by an invoice or a certificate stating the purity and the precise weight of the gold you are buying. Your invoice will show the weight to the last milligram and not the rounded off value, especially in case of gold jewelry. An exception to this rule is when you buy gold coins and biscuits in international standard packets or brands. While buying gold jewelry you can look for different measures of quality marking. The most common accredited markings are “hallmark” and the actual markings vary from one nation or the region to the other. You should also take care to preserve the invoice and certificate since that would come in handy when you desire to convert the gold into cash or any other asset.

Make A good Golden Deal!

In the information age, it is never difficult to obtain the most latent information on gold and verify whether a particular deal that you are contemplating is genuine or not. Make the best use of the internet and all that it has to offer, before you part with your hard earned money on the assumption that you are buying gold of the stated quantity and quality. More importantly, you should look for vendors who will unconditionally buy back gold at rates prevailing on the date of sale (after deducting minimum incidentals and overheads) (Gold jewelry that is in continuous use can lose a few milligrams over a period of time due to wear and tear).

When you are making an investment in the precious metals, always ensure that you are buying from a reputed vendor. The seemingly cheap offers or ‘distress sale’ by a friend or family member can potentially be a trap. And, the last post to avoid is the auction sites on the internet because gold always has takers at ruling prices.

Comments

What you think?

Recent Articles

-

Riche Niche: Health | Lifestyle | Fashion | Marketing | Technology

Mar 14, 25 09:18 AM

Our Riche Niche blog is the easiest way to stay up-to-date with the latest news, trends and articles published on this site. -

The Therapeutic Potential of Medical Cannabis Vaporization

Aug 05, 24 09:32 PM

The use of medical cannabis has been a subject of much debate and research over the years. With the growing acceptance of cannabis for medical purposes, various methods of administration have been exp… -

Amazon Spring Sale: A Season of Spectacular Savings

Mar 18, 24 08:38 AM

Amazon Spring Sale: A Season of Spectacular Savings -

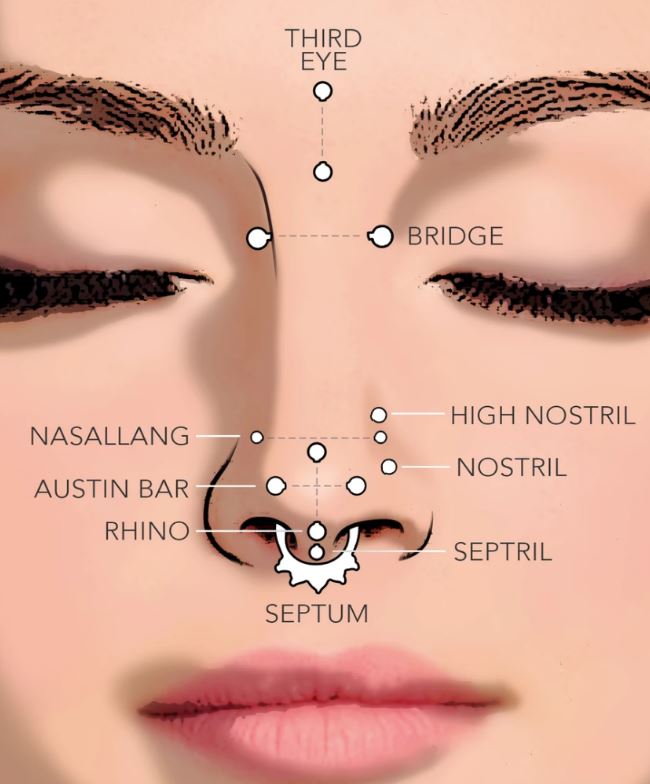

Understanding Nose Piercing Types: A Guide for Teens

Mar 16, 24 09:19 AM

Explore the rising trend of nose piercings among teenagers, understanding the various types and their cultural implications for a stylish appeal. -

Infected Nose Piercing

Mar 16, 24 09:18 AM

You can expect symptoms of infected nose piercing to resemble any other kind of body piercing infection. -

EMS manufacturing services in Malaysia

Mar 09, 24 10:33 PM

Malaysia is one of the leading countries in Southeast Asia that offers EMS manufacturing services to both local and international clients. -

Laundry Business: The Need for Payment System Upgrades

Mar 08, 24 11:14 AM

Discover the benefits of upgrading your laundry business's payment system. Enhance efficiency, increase profits, and improve customer convenience. -

Nose Peircing Store

Feb 18, 24 02:38 AM

A collection of latest at our nose peircing store. -

How to Choose the Right Coffee Maker for Your Needs

Feb 18, 24 02:12 AM

We'll compare the pros and cons of four common types of coffee makers: drip, French press, espresso, and vacuum. We'll also give you some tips on how to choose the right one based on your preferences… -

Emulate Celebrities with Nose Piercings

Feb 06, 24 08:13 AM

Discover the celebrities with nose piercing and get inspired for your next piercing! From studs to septum rings, our list has it all. Read more! -

Types of Nose Rings

Feb 06, 24 08:11 AM

Types of Nose Rings -

Is my nose piercing ring is sinking in?

Feb 06, 24 08:10 AM

Is my nose piercing ring is sinking in? Or just swollen? -

Dry Herb Vape Pens-Discover the Advantages of Malaysian Made

Feb 04, 24 12:39 PM

Choose our non-China dry herb vape pen for its high production standards, strict quality control, and excellent craftsmanship. -

Trinity Nose Ring A Unique Fashion Statement

Feb 03, 24 08:36 PM

Explore the world of trinity nose rings, a unique piece of jewelry that adds elegance and style to your look. Understand the different types and choose the right one for you. -

Redefining Beauty: The Rise of Nose Piercing Trend in the USA

Feb 02, 24 08:34 AM

Explore the evolution of the nose piercing trend in the USA, from ancient tradition to modern expression of individuality.