Sponsor Ads

Non-China Vape, 510 Cartridges & Battery Device Maker

If you are going for a vape manufacturer out of China we are you best choice. We offer a alternative vape production location with a very competitive price. You can save money by buying directly from us the manufacturer, without any middlemen or extra fees. You can also enjoy discounts for bulk orders and special offers for long term & loyal customers.

We offer small trial orders where you can test the quality and performance of the products before placing a large order. Fast shipping and cheaper shipping cost from Malaysia and Singapore ports. You don't have to wait long to receive your products.

Contact Us!

Contribute for our website Maintenance! We want to keep it free for all visitors.

Trending Best Sellers

Gold Barrick – Leader in Production and Market Capitalization

Trending Best Sellers

Gold Barrick was initially a privately held oil and gas company in North America. After incurring heavy financial losses in this sector, they decided to turn their attention to gold. The name Barrick Gold Corporation was changed from American Barrick Resources to Barrick Gold Corporation and they became the second largest gold producer in the world by 2001.

Barrick Gold Corporation is engaged in many related activities apart from the actual production and sale of gold. They also hold interests in oil and gas and their properties are located in Canada. The Gold Barrick gold mines are concentrated in North and South America as well as Australia Pacific which are their regional business units. The equity interest that they hold in African Barrick Gold plc is 73.9%.

Gold is perhaps one of the most important commodities on the market that has doubled in value in the last five years and broken several price records. People are in a constant dilemma about buying, hoarding or selling gold today. Due to the growing economies, the demand for these resources is increasing. As a result the shortage of other commodities such as food, potable water, crude oil, energy, minerals and usable land have resulted. The dollar has been steadily losing its purchasing power as a lot of money is being spent from the US Federal Reserves.

Barrick Gold-Mining Gold

Mining of gold is controlled tightly to prevent excess golf from flooding the market. The largest supply of gold comes from gold mining and these forces the price of gold to fall. Since gold is rare, old mines are generally shut down when new mines are found as this keeps the supply low and consistent.

It is speculated that the currency status of the American dollar’s reserve may be replaced by other currencies and till then people will continue to buy gold. The US Government is beginning to lose its credibility with other countries globally as they are becoming the world’s largest debtor instead of crediting. This may make their position negative from stable.

The price of precious metals has been steadily falling for the past two years. The price of gold was recently priced at over $1600 per ounce. People are always considering whether to buy, sell or hold their gold. People are continuing to be attracted to purchasing gold. Gold Barrick highlighted the need for change and assured that they were re-focusing on their business by taking action on the principle that “returns will drive production but production will not drive returns.”

Investors generally reason that the gold market rises when the stock market is down. This may be possible in the current marketplace. Stock brokers are capable of giving good advice if you wish to invest in gold stocks. Check out the international gold stocks that are noteworthy, such as Barrick Gold Corp, Newmont Mining, Goldcorp Inc., and Kinross Gold Corp. Gold Barrick’s vision is to be the world’s best gold mining company. It is however advisable for investors to make sure that the gold stocks traded match the potential of investment risk.

India and China has experienced a slowdown in the jewelry making scene using gold. This could also be the result of the fluctuation in the supply and demand. It is advisable to invest in a comfortable level of gold after getting advice from a stock expert or analyst.

There are many definitions of country risk, which includes factors such as exchange rate risk, political risk, economic risk, transfer risk, sovereign risk and socioeconomic risk amid others. Gold Barrick is recommended by stock brokers who assess the market valuation, global financial conditions and value and yield attractions.

Comments

What you think?

Recent Articles

-

Riche Niche: Health | Lifestyle | Fashion | Marketing | Technology

Mar 14, 25 09:18 AM

Our Riche Niche blog is the easiest way to stay up-to-date with the latest news, trends and articles published on this site. -

The Therapeutic Potential of Medical Cannabis Vaporization

Aug 05, 24 09:32 PM

The use of medical cannabis has been a subject of much debate and research over the years. With the growing acceptance of cannabis for medical purposes, various methods of administration have been exp… -

Amazon Spring Sale: A Season of Spectacular Savings

Mar 18, 24 08:38 AM

Amazon Spring Sale: A Season of Spectacular Savings -

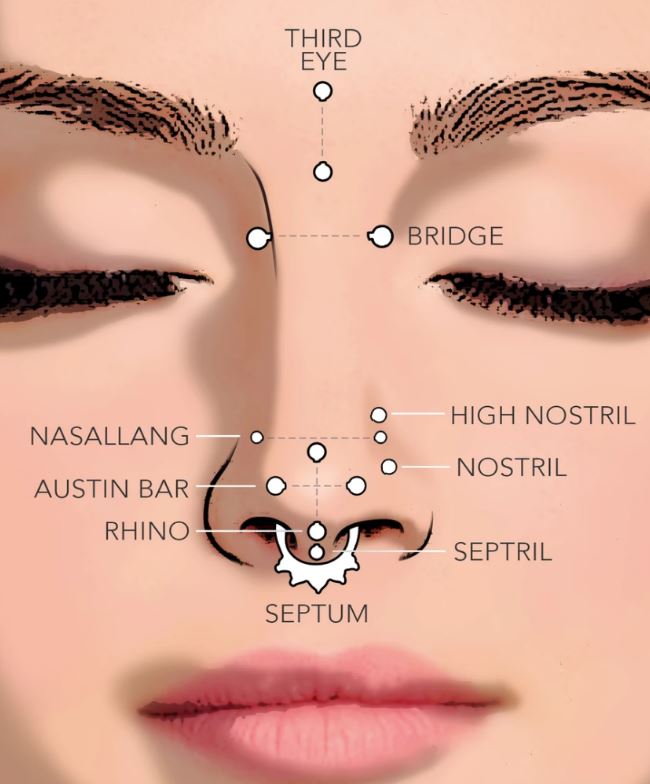

Understanding Nose Piercing Types: A Guide for Teens

Mar 16, 24 09:19 AM

Explore the rising trend of nose piercings among teenagers, understanding the various types and their cultural implications for a stylish appeal. -

Infected Nose Piercing

Mar 16, 24 09:18 AM

You can expect symptoms of infected nose piercing to resemble any other kind of body piercing infection. -

EMS manufacturing services in Malaysia

Mar 09, 24 10:33 PM

Malaysia is one of the leading countries in Southeast Asia that offers EMS manufacturing services to both local and international clients. -

Laundry Business: The Need for Payment System Upgrades

Mar 08, 24 11:14 AM

Discover the benefits of upgrading your laundry business's payment system. Enhance efficiency, increase profits, and improve customer convenience. -

Nose Peircing Store

Feb 18, 24 02:38 AM

A collection of latest at our nose peircing store. -

How to Choose the Right Coffee Maker for Your Needs

Feb 18, 24 02:12 AM

We'll compare the pros and cons of four common types of coffee makers: drip, French press, espresso, and vacuum. We'll also give you some tips on how to choose the right one based on your preferences… -

Emulate Celebrities with Nose Piercings

Feb 06, 24 08:13 AM

Discover the celebrities with nose piercing and get inspired for your next piercing! From studs to septum rings, our list has it all. Read more! -

Types of Nose Rings

Feb 06, 24 08:11 AM

Types of Nose Rings -

Is my nose piercing ring is sinking in?

Feb 06, 24 08:10 AM

Is my nose piercing ring is sinking in? Or just swollen? -

Dry Herb Vape Pens-Discover the Advantages of Malaysian Made

Feb 04, 24 12:39 PM

Choose our non-China dry herb vape pen for its high production standards, strict quality control, and excellent craftsmanship. -

Trinity Nose Ring A Unique Fashion Statement

Feb 03, 24 08:36 PM

Explore the world of trinity nose rings, a unique piece of jewelry that adds elegance and style to your look. Understand the different types and choose the right one for you. -

Redefining Beauty: The Rise of Nose Piercing Trend in the USA

Feb 02, 24 08:34 AM

Explore the evolution of the nose piercing trend in the USA, from ancient tradition to modern expression of individuality.