Sponsor Ads

Non-China Vape, 510 Cartridges & Battery Device Maker

If you are going for a vape manufacturer out of China we are you best choice. We offer a alternative vape production location with a very competitive price. You can save money by buying directly from us the manufacturer, without any middlemen or extra fees. You can also enjoy discounts for bulk orders and special offers for long term & loyal customers.

We offer small trial orders where you can test the quality and performance of the products before placing a large order. Fast shipping and cheaper shipping cost from Malaysia and Singapore ports. You don't have to wait long to receive your products.

Contact Us!

Contribute for our website Maintenance! We want to keep it free for all visitors.

Trending Best Sellers

Coronavirus Effects Of Slump In Gold And Silver Prices

“Coronavirus Effects Of Slump In Gold And Silver Prices continues to suffer from risk-off panics in the market, trading back below $1,500 level as S&P futures gave up stimulus driven gains,” said Tai Wong, head of base and precious metals derivatives trading at BMO. “Liquidity here, as in most markets, is deeply compromised and we expect to see continuing volatility, mood-driven swings.”

India; In the domestic market, gold jumped Rs 455 to Rs 41,610 per 10 gram in Delhi amid rupee depreciation. Silver prices, however, dropped by Rs 1,283 to Rs 40,304 per kg from Rs 41,587.

Wall Street’s main indexes slumped and oil prices continued to slide as investors’ appetite for riskier assets remained weak on growing signs of coronavirus damage to the global economy.

Further weighing on gold, the dollar index jumped to a near three-year high. The virus, which has so far infected over 205,000 people and killed more than 8,200 worldwide, has wreaked havoc in markets as countries around the world go into lockdown to contain the spread.

Gold tumbled 3 percent on Tuesday, while other precious metals also extended heavy losses from the previous session, as fears over the global economic toll from the fast-spreading coronavirus prompted investors to dump most assets and hoard cash.

Globally, the precious metals are caught up in a broader tumble in stock markets, as the coronavirus continued to spread rapidly, with some investors obliged to sell assets to cover margin calls, Reuters reported.

Global commodity market witnessed severe selling pressure on Monday, in line with the equities, amid fears that the rising coronavirus cases may severely impact the global economy.

Coronavirus Effects Of Slump In Gold And Silver Prices continued to decline in domestic markets, extending their recent fall. On MCX, gold futures fell 2% or about ₹800 to ₹38,755 per 10 gram. Gold had shed about ₹5,000 per 10 gram in previous five sessions, falling from ₹44,500 levels. Silver also continued to remain under pressure. Gold is typically viewed as a safe harbor in times of turmoil in global financial markets. But the recent sharp fall in gold prices has been attributed to flight for cash amid heightened volatility across markets over the coronavirus scare.

The recent buzz is all about gold and silver prices. Will gold continue to remain in a bubble by the quarter of this year? The fear of inflation has pushed the price of gold down this year. This has kick- started Japan’s economy as investors zeroed in and started purchasing gold. As the gold and silver prices started slumping, investors began to sell their silver to cover the losses from the slump of 1.6% of gold. Investors began to bet on an upturn of the Japanese yen as the Japanese were cautions that the economy of Japan would suffer if there were further falls in their currency.

Coronavirus Effects Of Slump In Gold And Silver Prices

Coronavirus Effects Of Slump In Gold And Silver Prices was not unusual in Australia In the March quarter the Surbiton’s quarterly gold survey indicated that the production had fallen by about 5% in the March quarter. In reference to Australian dollar terms, gold had forecasted to fall about 4% in April. Fold producers may focus now on higher grades of ore. The rising gold and silver prices had earlier made it economic to treat lower grade ore. Nearly 150 jobs have been cut at Newcrest Ministry in March.

In Russia, there has been an increase of 34 metric tons in the first three months of this year. Other eastern European countries such as Kazakhstan, Azerbaijan, Tajikistan, Kyrgyz Republic and Serbia continue to buy in small volumes.

In Singapore and Hong Kong customers are paying premiums on precious metals as the stocks run low. This is the result of high-volume buying in the past weeks. A market strategist at IG Markets in Singapore predicts that “the selling pressure will persist if equities and the U.S dollar continue to strengthen.”

In India and China, the physical demand for gold soared in mid-April last year as investors turned to precious metals for long-term value. In the first three months the demand for gold in China rose by nearly 20% and by 27% in India as a result of the slump in gold and silver prices. There is a continuous demand for bullion when the prices drop low in Asia.

In India, in spite of the 30% drop in silver prices people were not enticed to purchase the white metal. Consumers rushed to purchase gold and disregarded the meltdown in silver. After the initial rush to purchase gold, there is a slump again in the domestic market. The Indian government increased the import tax on gold three times in the past eighteen months. In India the rush of buying gold is slowing down even though the gold and silver prices are down. One of the reasons is the restriction on credit availability for imports by dealers. The rush that was noticed in mid-April will not be witnessed again in a long time.

As stated by Mainuddin Shah, an official at the bullion house in Mumbai, “Silver has been witnessing a reverse trend as compared to the global area where a slight drop in prices spurs demand”. The electronics industry is a major user of silver but the industrial demand has not been bright as the growth in this field has not escalated.

A lot of retail demand for gold is expected to be created in the next five to 10 years as income rises throughout the emerging world. A high demand for gold has been recorded in Asia especially in China and India due to the slump in gold and silver prices. There has been a paradigm shift in the attitudes of investors towards gold with “the dramatic gold sell-off in April” according to Robin Bhar an analyst. Speculators expect that gold producers are considering hedging on a larger scale this year. This would put downward pressure on prices which may result in a self-reinforced collapse in the gold price.

Comments

What you think?

Recent Articles

-

Riche Niche: Health | Lifestyle | Fashion | Marketing | Technology

Mar 14, 25 09:18 AM

Our Riche Niche blog is the easiest way to stay up-to-date with the latest news, trends and articles published on this site. -

The Therapeutic Potential of Medical Cannabis Vaporization

Aug 05, 24 09:32 PM

The use of medical cannabis has been a subject of much debate and research over the years. With the growing acceptance of cannabis for medical purposes, various methods of administration have been exp… -

Amazon Spring Sale: A Season of Spectacular Savings

Mar 18, 24 08:38 AM

Amazon Spring Sale: A Season of Spectacular Savings -

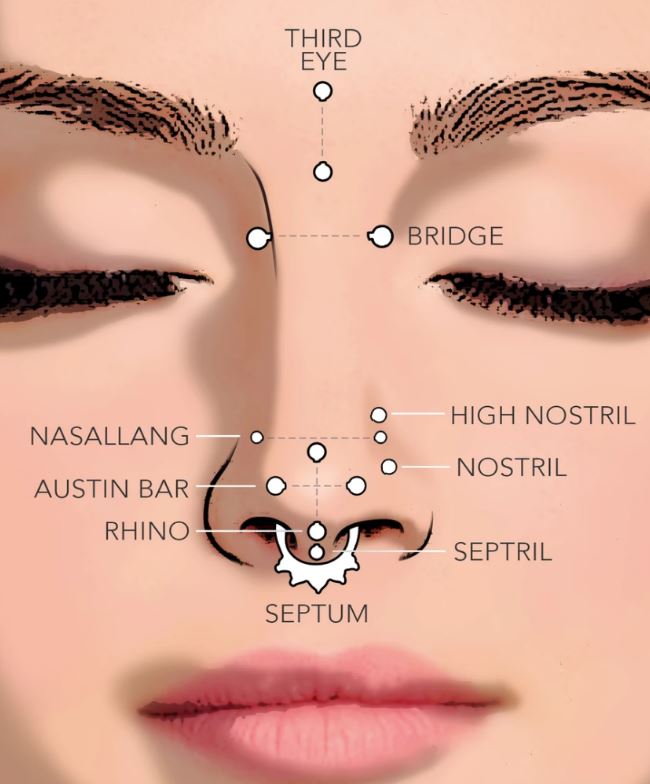

Understanding Nose Piercing Types: A Guide for Teens

Mar 16, 24 09:19 AM

Explore the rising trend of nose piercings among teenagers, understanding the various types and their cultural implications for a stylish appeal. -

Infected Nose Piercing

Mar 16, 24 09:18 AM

You can expect symptoms of infected nose piercing to resemble any other kind of body piercing infection. -

EMS manufacturing services in Malaysia

Mar 09, 24 10:33 PM

Malaysia is one of the leading countries in Southeast Asia that offers EMS manufacturing services to both local and international clients. -

Laundry Business: The Need for Payment System Upgrades

Mar 08, 24 11:14 AM

Discover the benefits of upgrading your laundry business's payment system. Enhance efficiency, increase profits, and improve customer convenience. -

Nose Peircing Store

Feb 18, 24 02:38 AM

A collection of latest at our nose peircing store. -

How to Choose the Right Coffee Maker for Your Needs

Feb 18, 24 02:12 AM

We'll compare the pros and cons of four common types of coffee makers: drip, French press, espresso, and vacuum. We'll also give you some tips on how to choose the right one based on your preferences… -

Emulate Celebrities with Nose Piercings

Feb 06, 24 08:13 AM

Discover the celebrities with nose piercing and get inspired for your next piercing! From studs to septum rings, our list has it all. Read more! -

Types of Nose Rings

Feb 06, 24 08:11 AM

Types of Nose Rings -

Is my nose piercing ring is sinking in?

Feb 06, 24 08:10 AM

Is my nose piercing ring is sinking in? Or just swollen? -

Dry Herb Vape Pens-Discover the Advantages of Malaysian Made

Feb 04, 24 12:39 PM

Choose our non-China dry herb vape pen for its high production standards, strict quality control, and excellent craftsmanship. -

Trinity Nose Ring A Unique Fashion Statement

Feb 03, 24 08:36 PM

Explore the world of trinity nose rings, a unique piece of jewelry that adds elegance and style to your look. Understand the different types and choose the right one for you. -

Redefining Beauty: The Rise of Nose Piercing Trend in the USA

Feb 02, 24 08:34 AM

Explore the evolution of the nose piercing trend in the USA, from ancient tradition to modern expression of individuality.